Key Findings

While job conditions and economic circumstances have been recovering from the COVID-19 crisis over the past year, glaring disparities in economic well-being have taken center stage in policy discussions. Many lower-income Californians continue to struggle to make ends meet while higher-income Californians have seen their fortunes rise. Meanwhile, changes in federal leadership coupled with a large increase in state revenues have set the context for a renewed focus on expanding educational opportunities and safety net programs to improve the lives and future prospects of lower-income Californians.

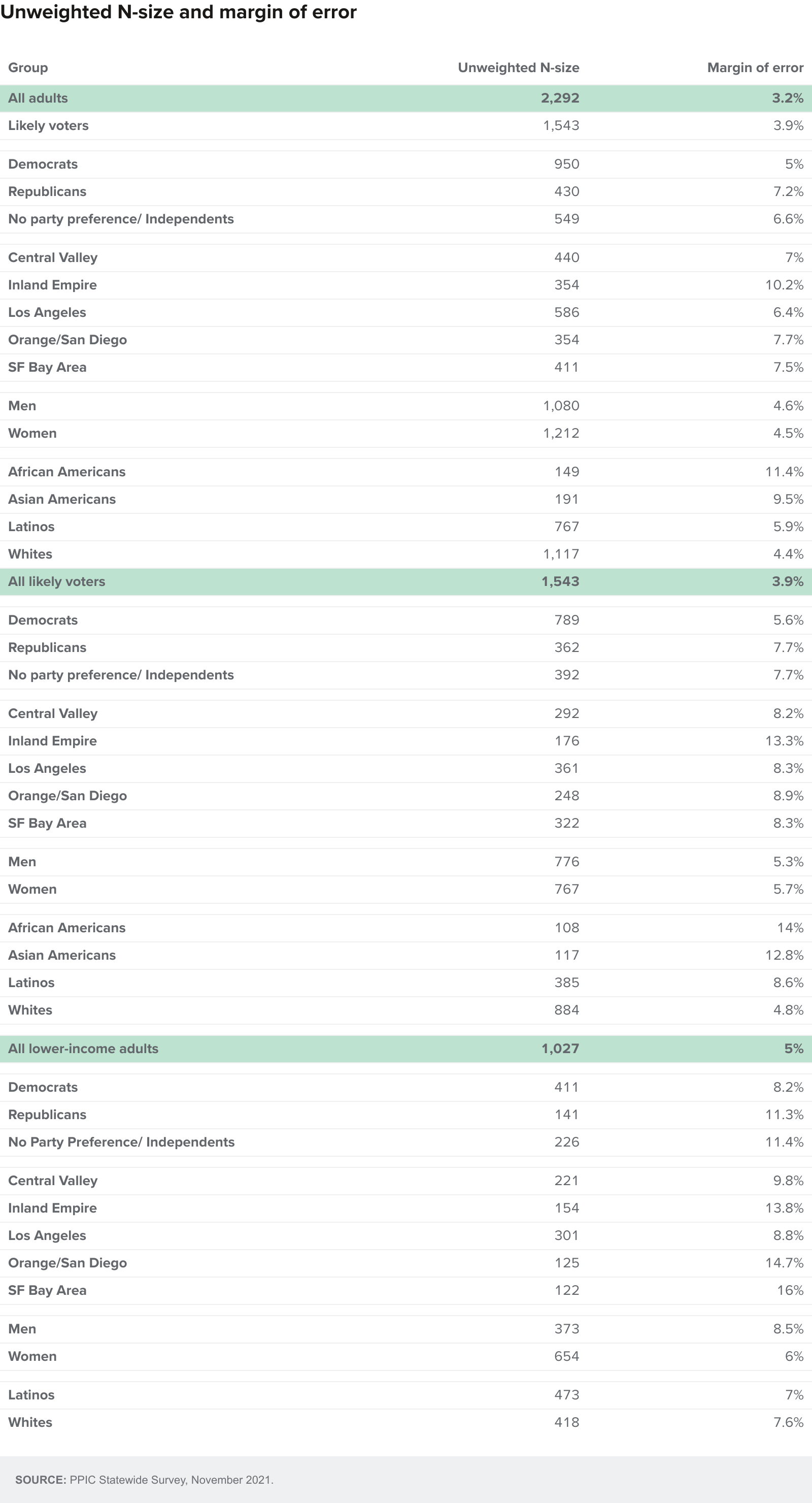

These are among the key findings of a statewide survey on state and national issues that was conducted from October 12 to October 31 by the Public Policy Institute of California:

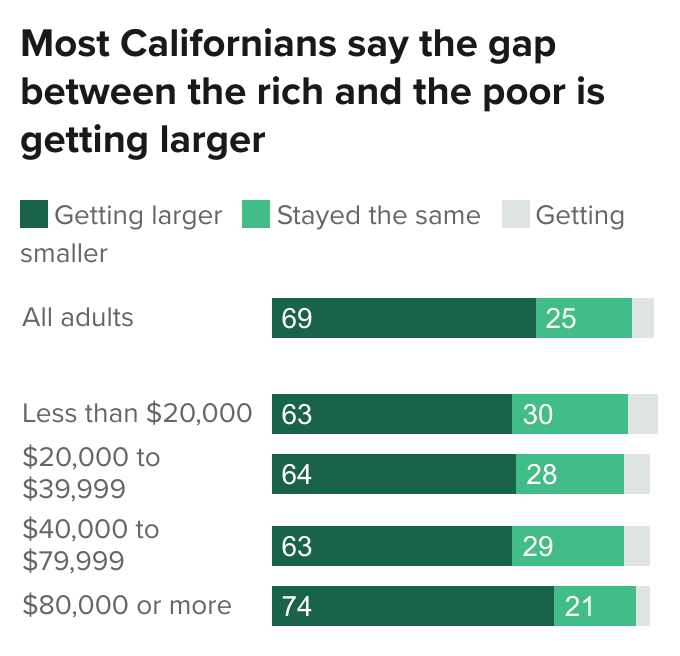

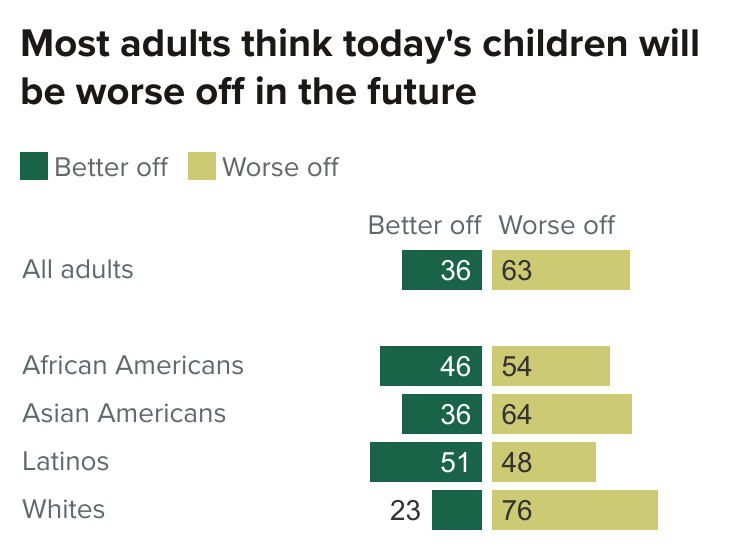

Solid majorities of Californians (69%) say the gap between the rich and the poor in their region is increasing and that it will be larger by the year 2030 (64%). Majorities across partisan groups and regions say that children growing up in California today will be worse off than their parents.

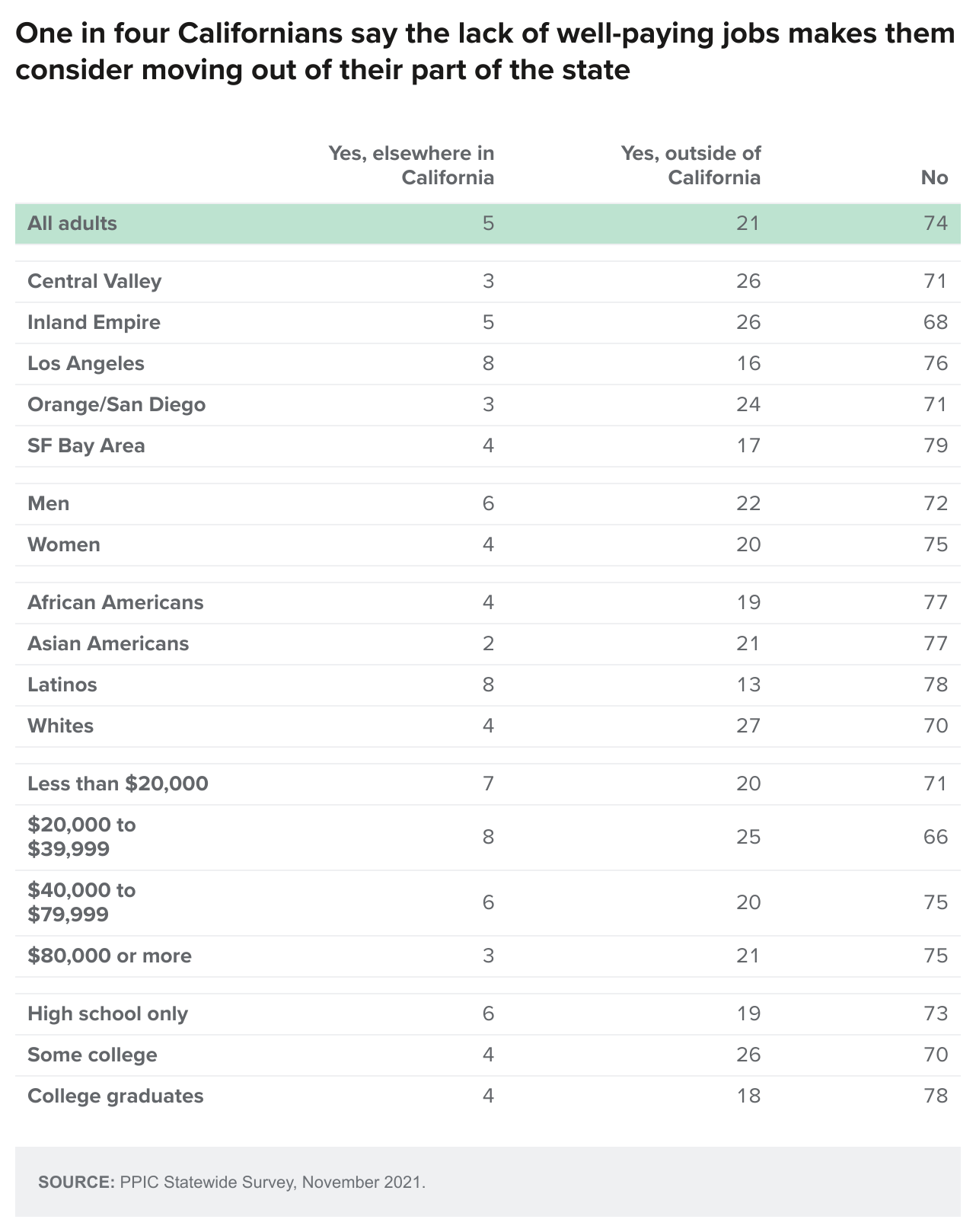

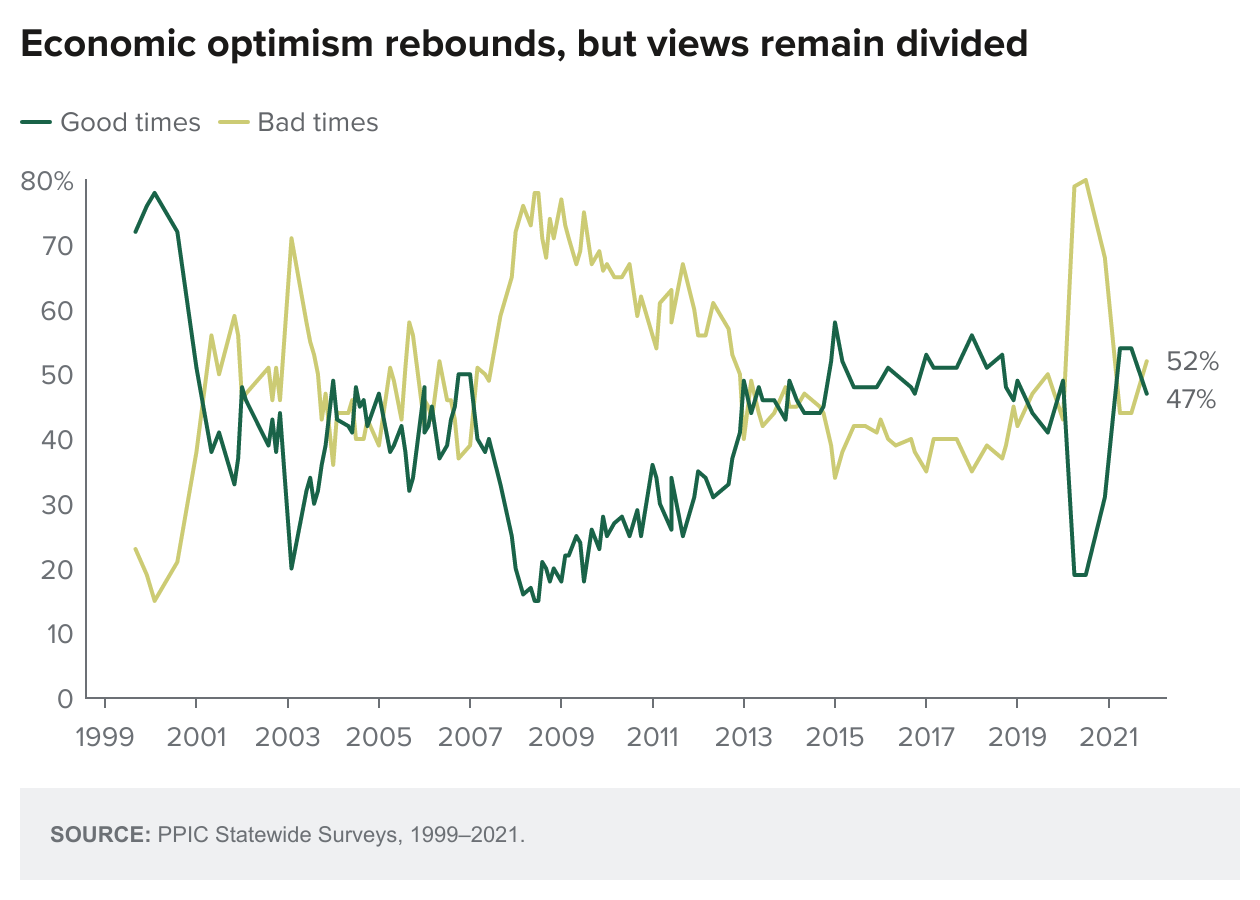

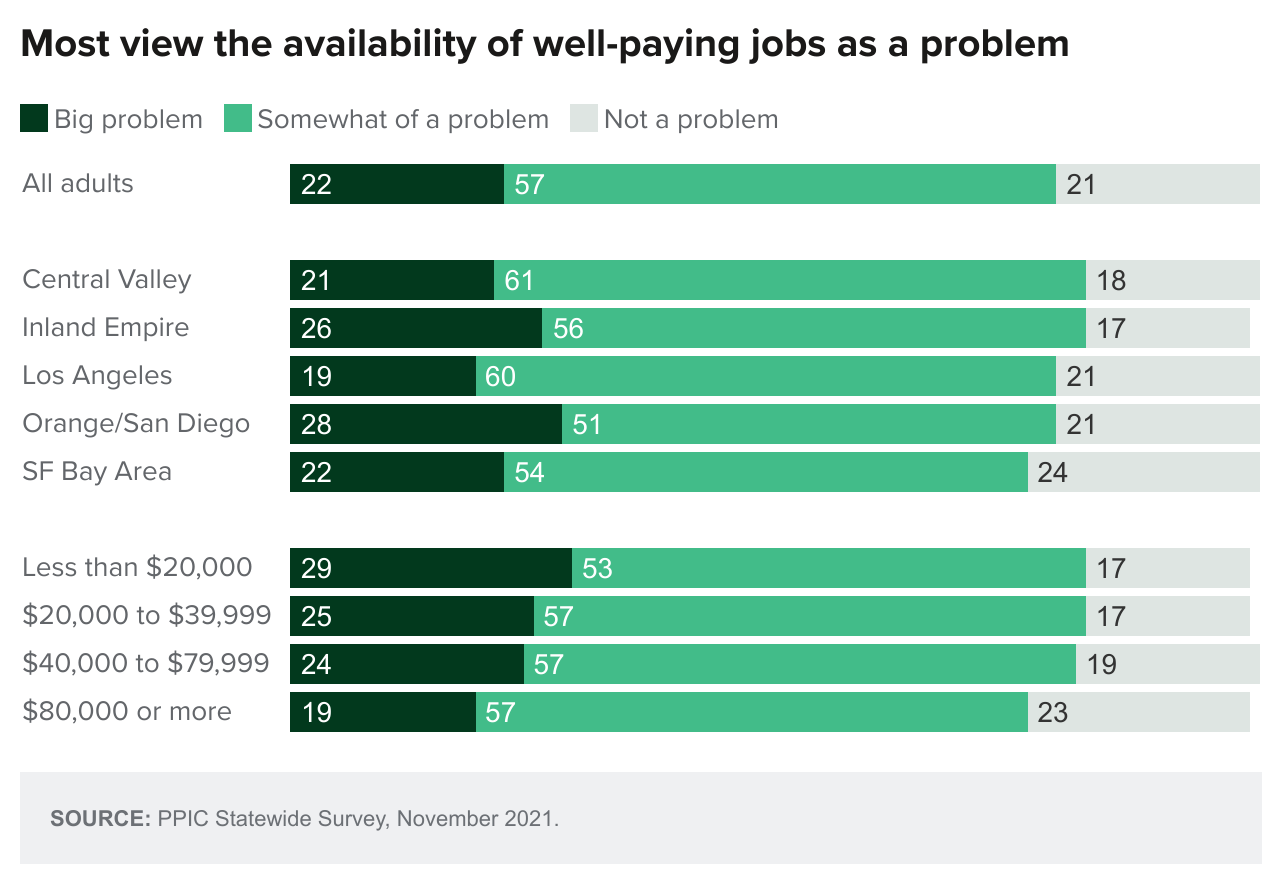

Solid majorities of Californians (69%) say the gap between the rich and the poor in their region is increasing and that it will be larger by the year 2030 (64%). Majorities across partisan groups and regions say that children growing up in California today will be worse off than their parents.- Californians have mixed views of the state’s economic outlook in the next 12 months (47% good times, 52% bad times). About one in five say the lack of well-paying jobs in their region is a big problem; a similar share say the lack of well-paying jobs is making them seriously consider moving out of the state. →

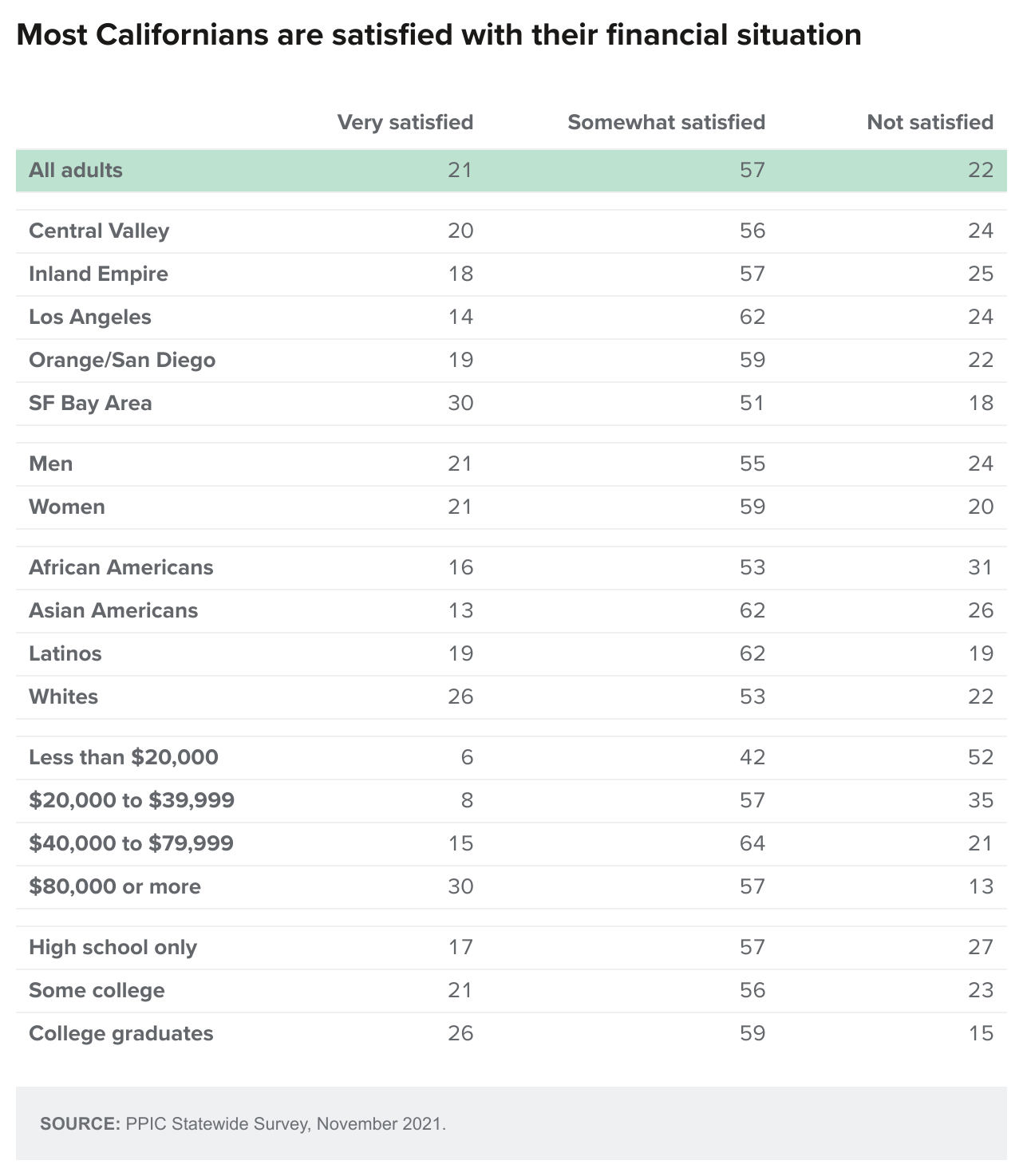

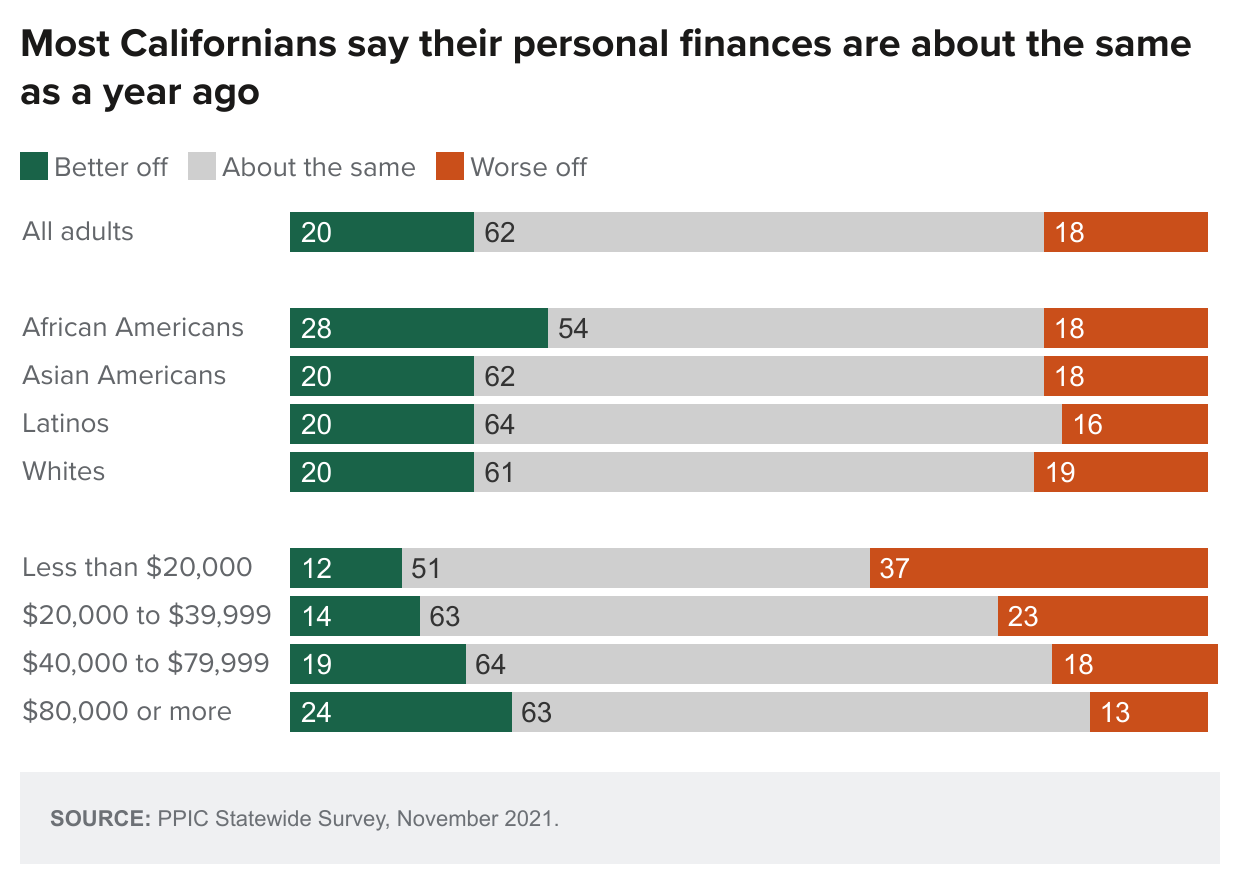

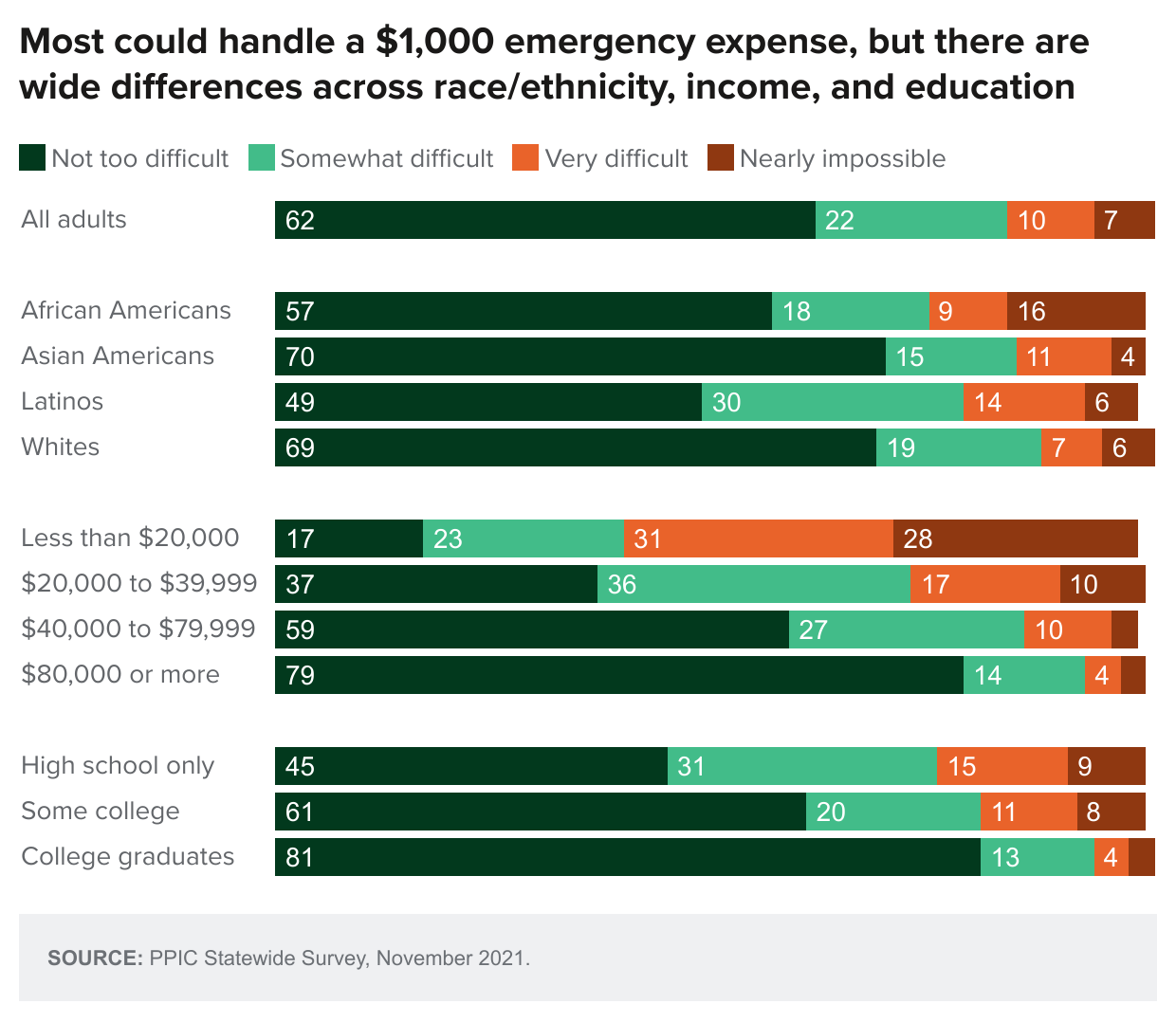

Most Californians (62%) say their finances today are the same as a year ago. Lower-income residents are more likely than others to say they are worse off financially than a year ago, to express dissatisfaction with their finances, and to say that it would be difficult to pay for a $1,000 emergency expense. →

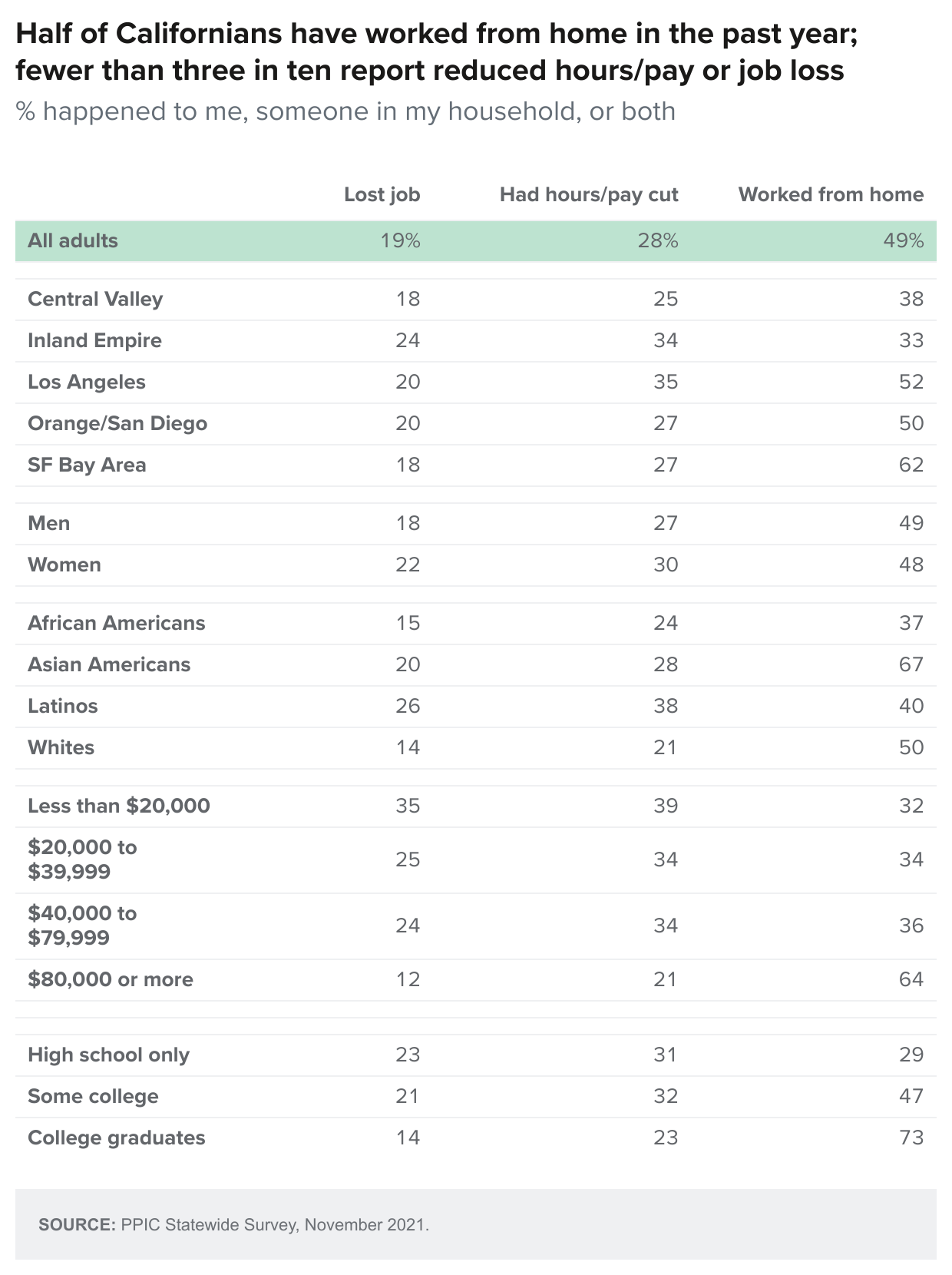

Most Californians (62%) say their finances today are the same as a year ago. Lower-income residents are more likely than others to say they are worse off financially than a year ago, to express dissatisfaction with their finances, and to say that it would be difficult to pay for a $1,000 emergency expense. →- Twenty-eight percent report that they or someone in their household had work hours reduced or pay cut in the last 12 months. Households with incomes under $80,000 are much more likely than higher-income households to have faced reduced pay or hours. Forty-nine percent say that they or someone in their household worked from home over the past year, with more-affluent Californians far more likely to say this. →

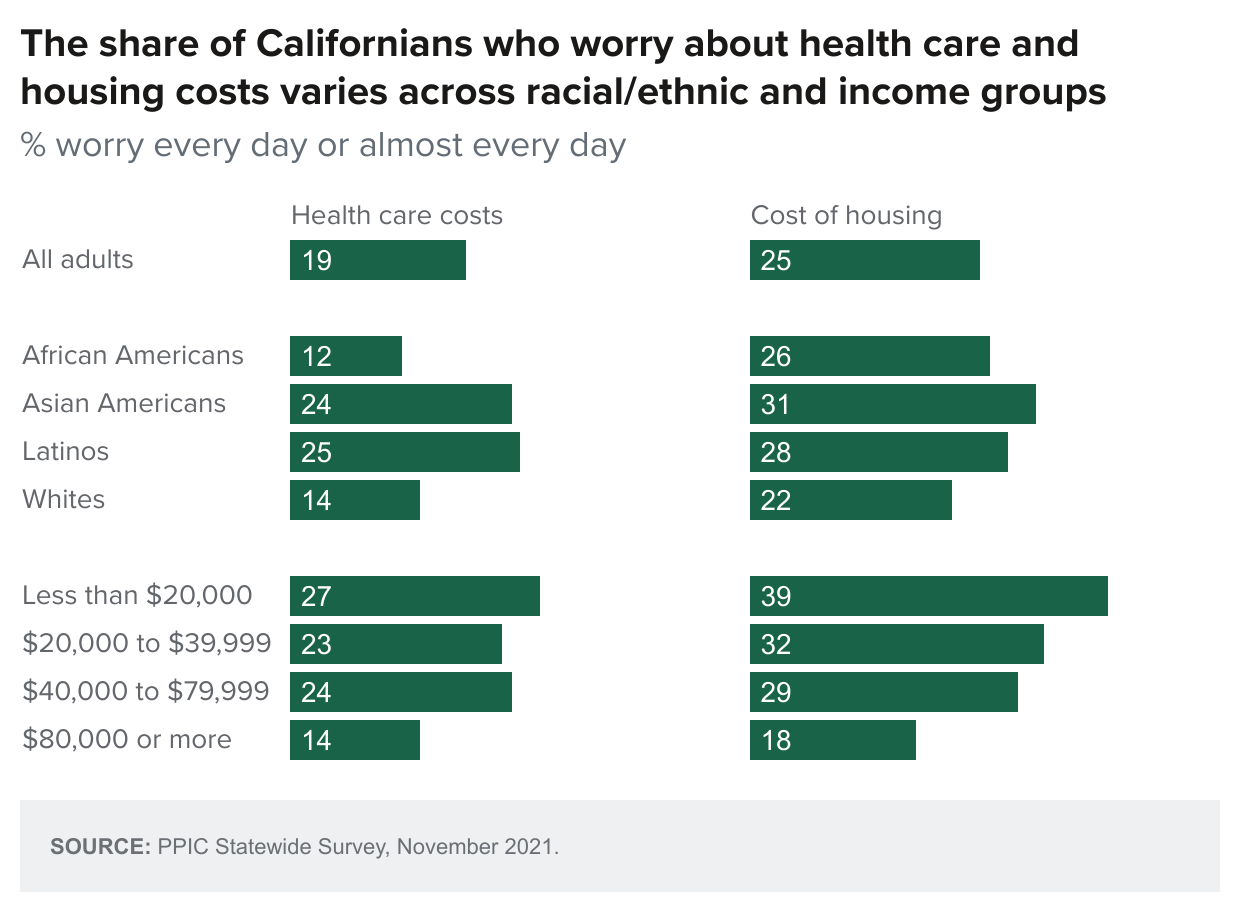

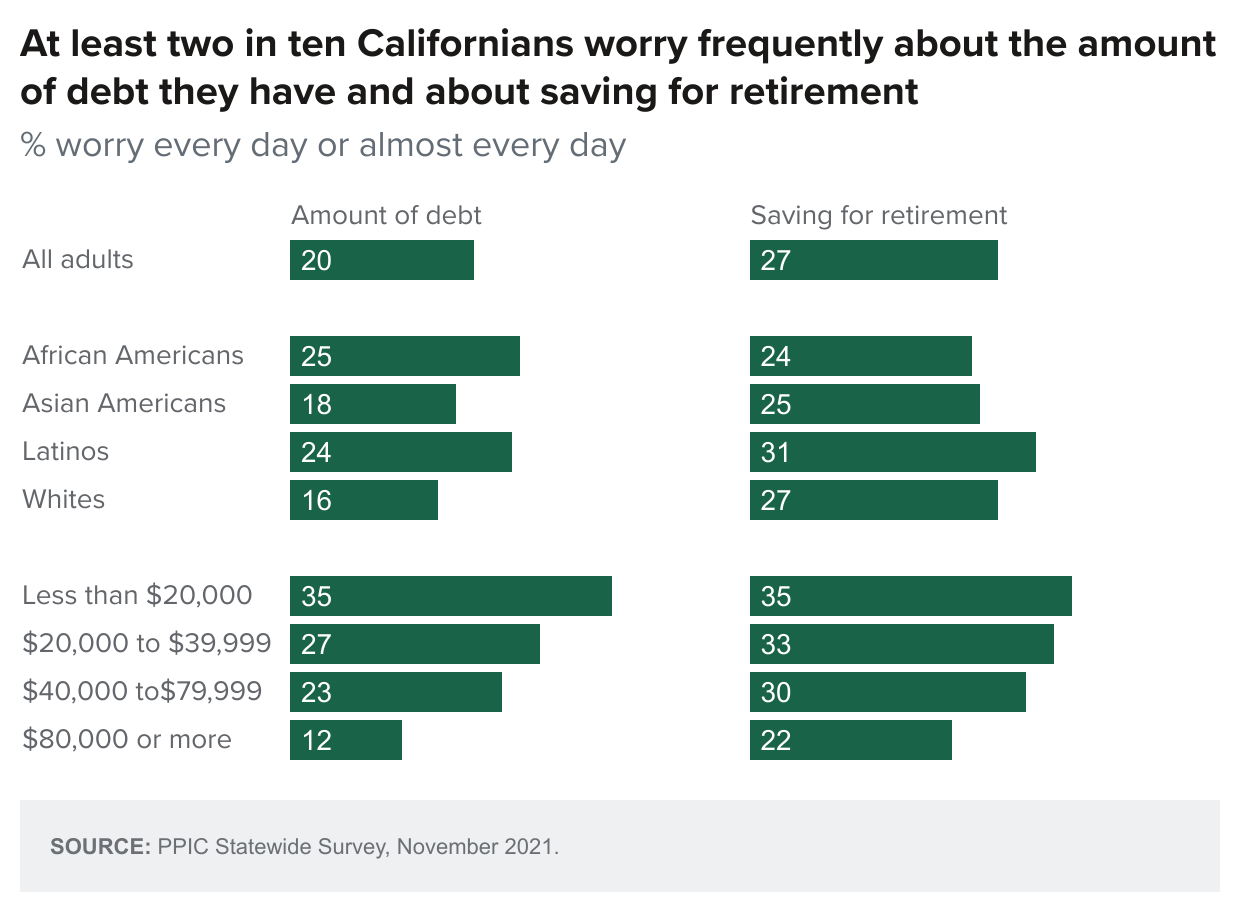

- Twenty-five percent of Californians and 36 percent of lower-income residents worry every day or almost every day about housing costs. Lower-income residents also worry more than those at higher income levels about paying their bills, the amount of debt they have, and saving enough for retirement. →

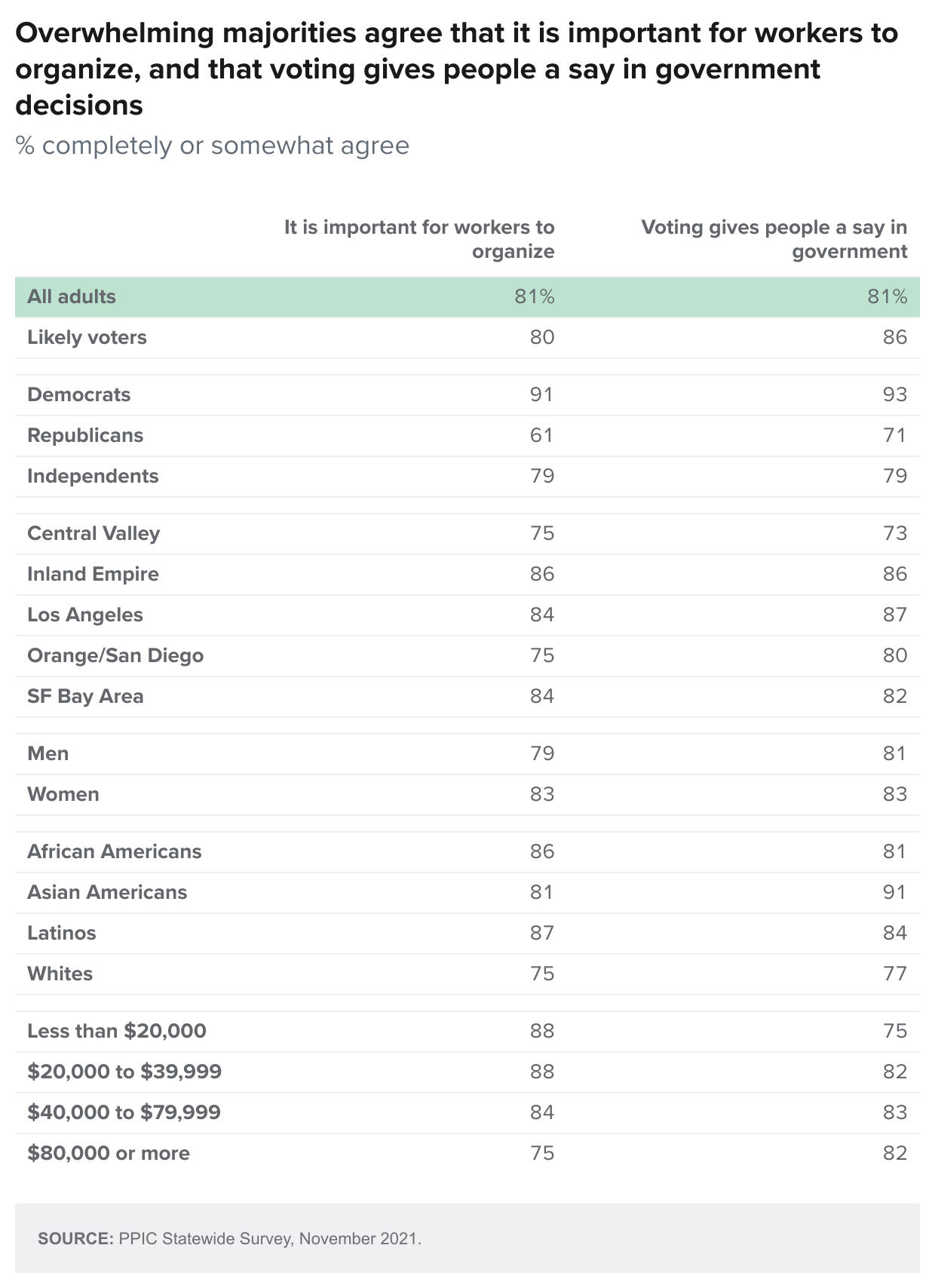

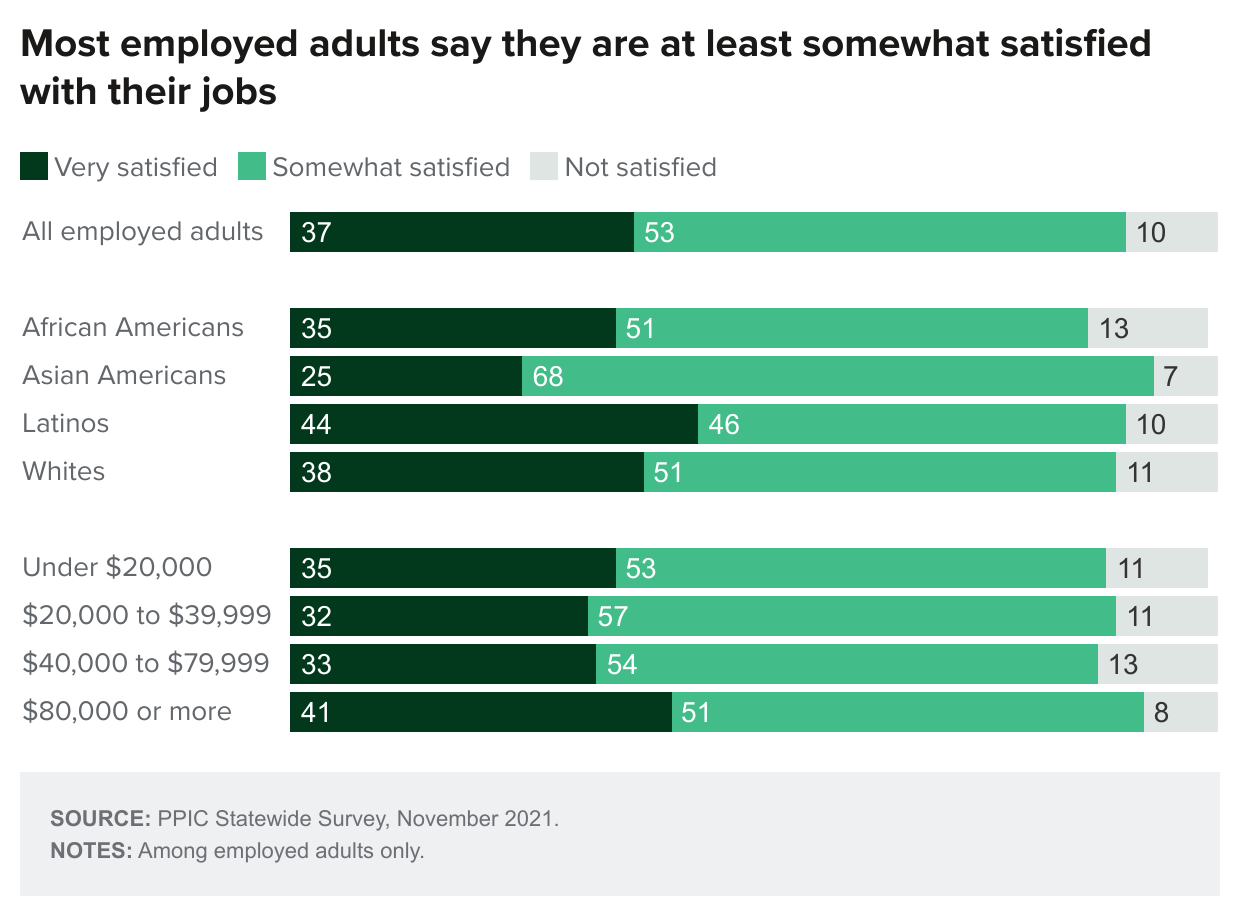

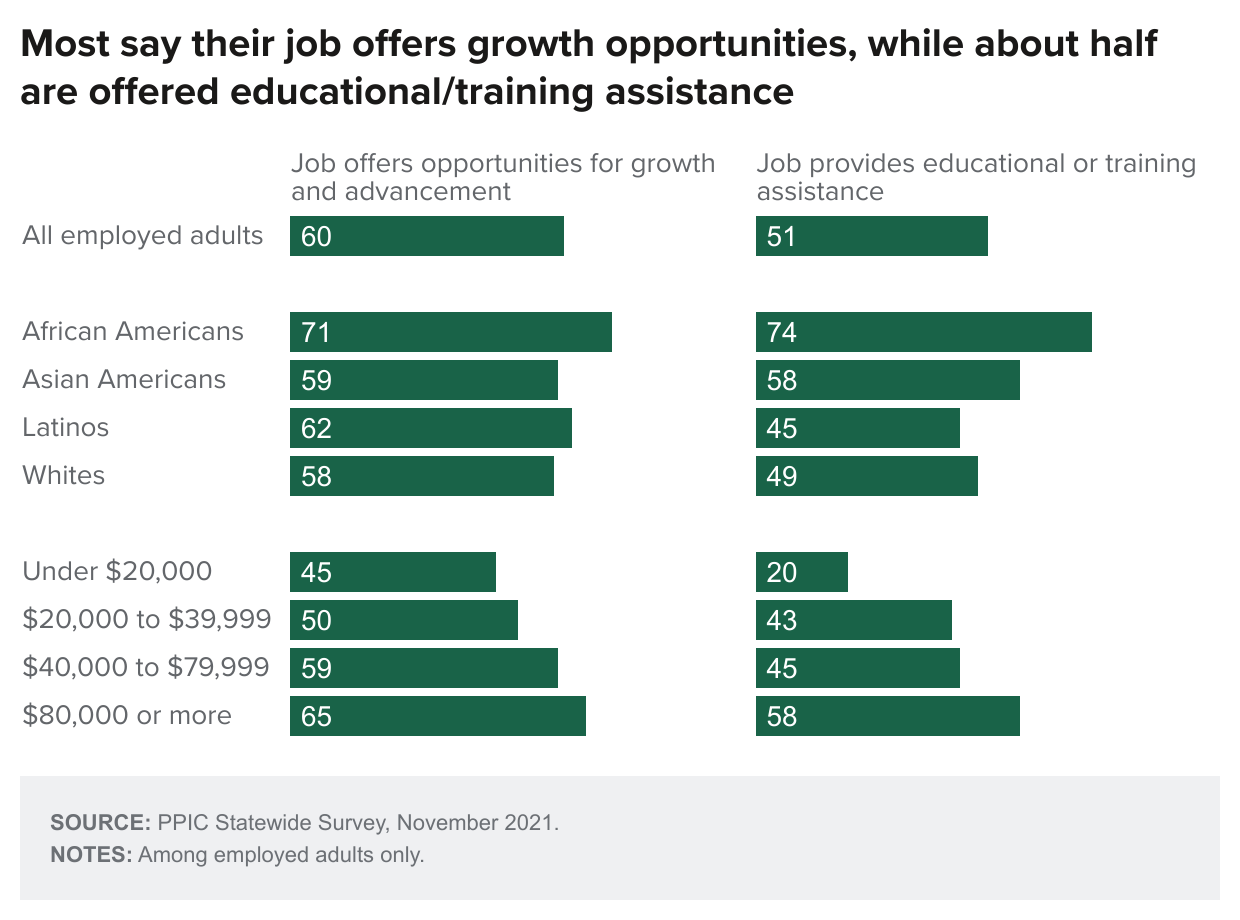

- Thirty-seven percent of employed residents are very satisfied with their jobs; the perception that their job offers opportunities for growth and advancement increases with rising education and income levels. Majorities across partisan and demographic groups agree that it is important for workers to organize so that employers do not take advantage of them. →

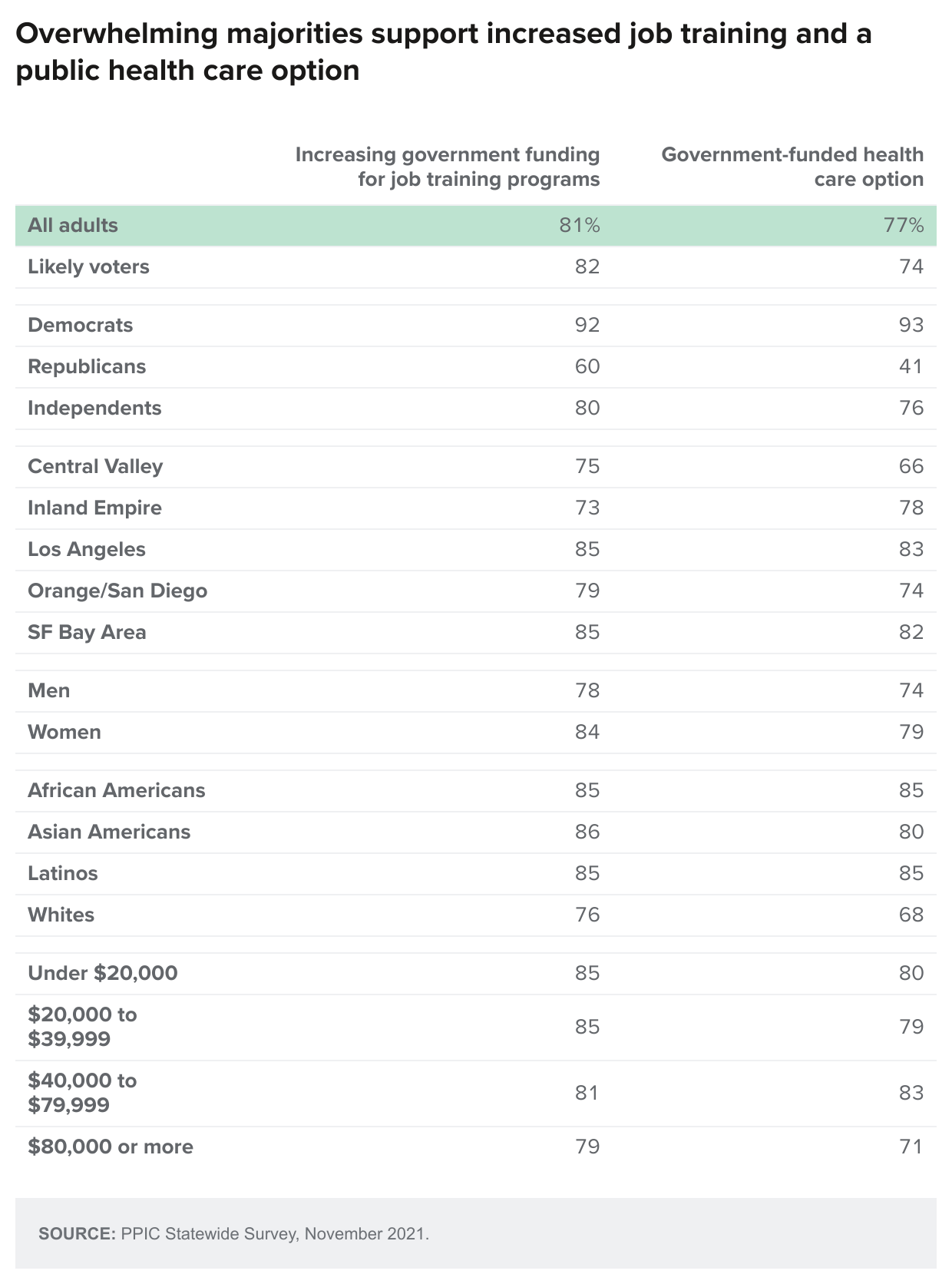

- An overwhelming majority of Californians (76%) favor increasing government funding so that childcare programs are available for more lower-income working parents. Solid majorities across partisan groups and regions favor increasing government funding for job training programs so that more workers have the skills they need for today’s jobs. →

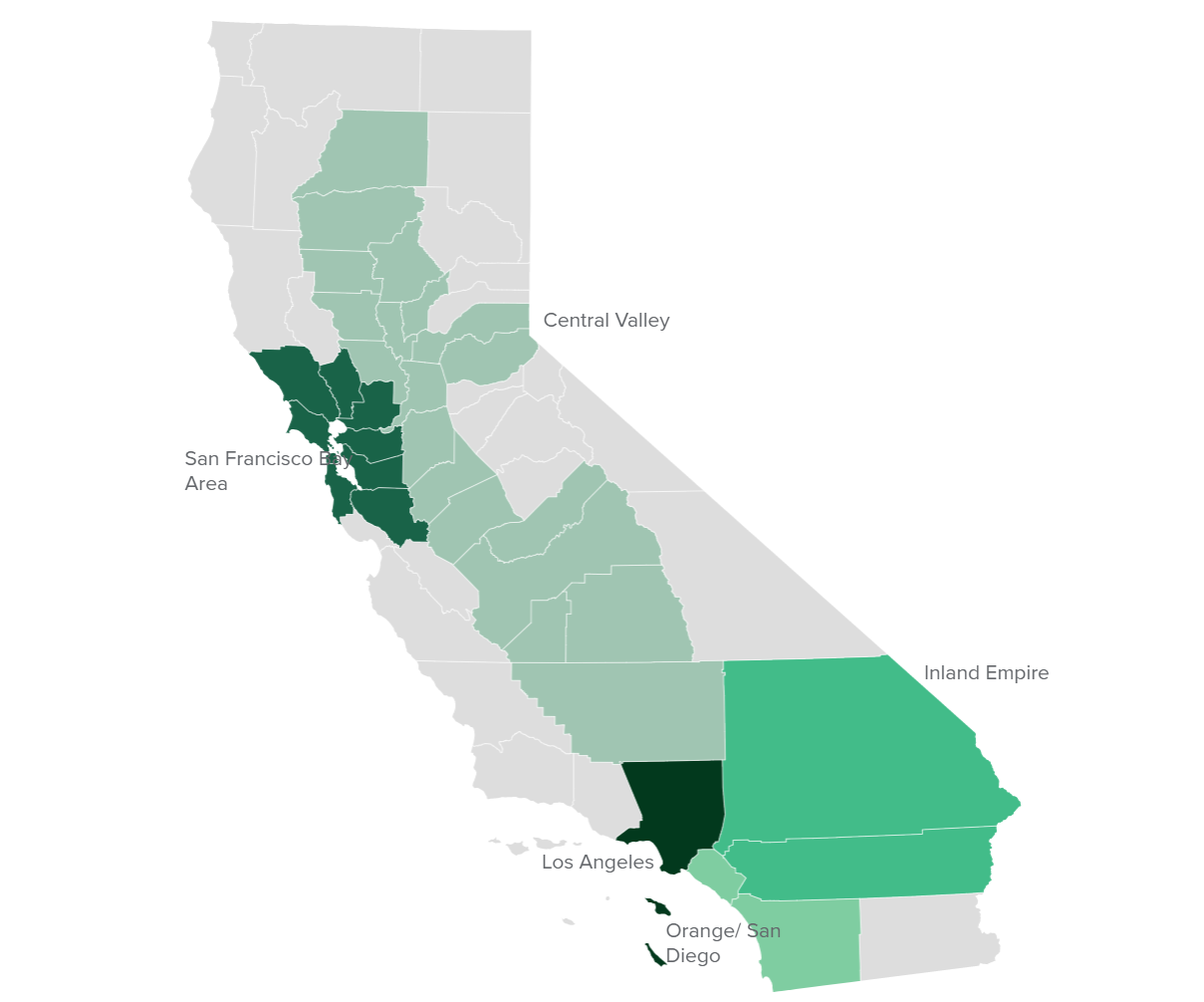

California Economy

Economic optimism among Californians has rebounded since the early days of the pandemic: the share expressing optimism is similar to that of January 2020. However, fewer than half expect good economic times in the next 12 months. Majorities across income groups are pessimistic about the economy. Notably, majorities of Latinos (57%) and African Americans (54%) say good times are ahead, compared to about four in ten Asian Americans (43%) and whites (39%). Half of residents in Los Angeles and the San Francisco Bay Area are optimistic, while majorities in the Central Valley, the Inland Empire, and Orange/San Diego are pessimistic.

Most Californians say the availability of well-paying jobs is a problem in their part of the state, and 22 percent consider it a big problem. Residents in the Inland Empire and Orange/San Diego are slightly more likely to say this is a big problem than those in other regions. Californians in households making less than $20,000 a year are more likely than those making $80,000 or more to view the availability of well-paying jobs as a big problem. Overwhelming majorities across age, education, gender, and racial/ethnic groups view this as a problem. Notably, 26 percent of Californians say they have seriously considered moving from their part of the state because of the lack of well-paying jobs. Among those who have considered moving, most would leave the state rather than go somewhere else in California.

Personal Finances

When asked about their personal finances, most Californians say they are doing about as well as they were a year ago, while one in six say they are worse off and about one in five say they are better off. Those making less than $20,000 per year are nearly three times more likely than those making $80,000 or more to say they are worse off (37% vs. 13%). College graduates are twice as likely as those with a high school diploma or less to say they are better off (29% vs. 14%). Majorities across regions and across age, education, gender, and racial/ethnic groups say they are doing about the same financially as last year.

When asked how difficult it would be to handle a $1,000 emergency expense, most Californians say that it would not be too difficult; however, there are differences across demographic groups. Californians in households with annual incomes under $40,000 are far less likely than those making $40,000 or more to say this expense would be not too difficult. Notably, about three in ten in the lowest-income households say this expense would be nearly impossible and another three in ten say it would be very difficult. Across racial/ethnic groups, whites and Asian Americans are much more likely to say this expense would be not too difficult. The share holding this view increases with rising educational attainment. Overall, most Californians (78%) are satisfied with their current financial situation, with 21 percent saying they are very satisfied. People of color, those with less formal education, and lower-income Californians are less likely to be very satisfied with their financial situation.

Economic Security

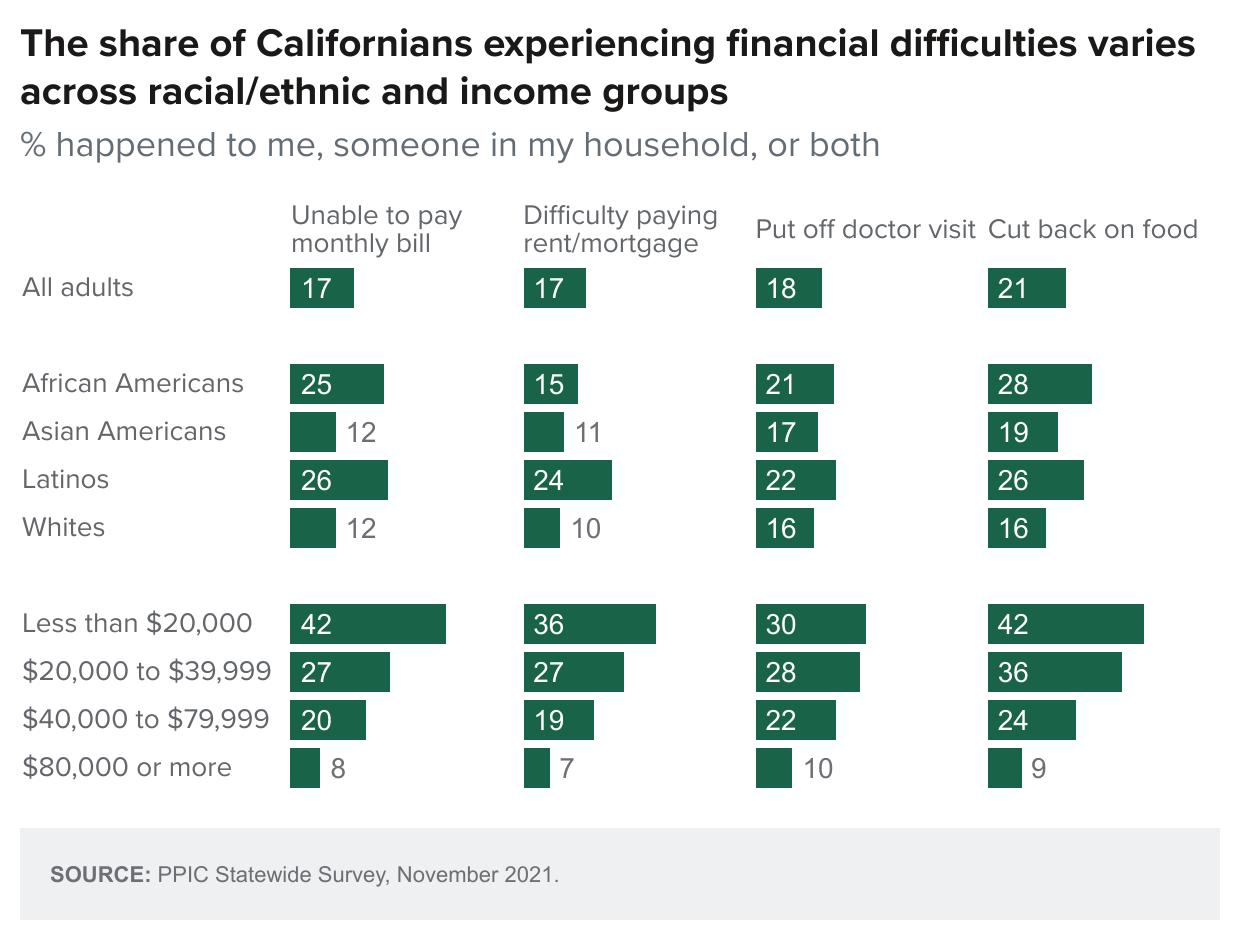

About one in five Californians report that they or someone in their household has cut back on food (21%), put off seeing a doctor or purchasing medicine to save money (18%), been unable to pay a monthly bill (17%), or had difficulty paying the rent or mortgage (17%) in the last 12 months. Results were similar last November, when many statewide restrictions were still in effect. Significant differences across income groups are present. More than one in four households earning less than $40,000 report these difficulties, compared to one in ten (or fewer) households making more than $80,000. Across racial/ethnic groups, Latinos and African Americans are the most likely to report any of these issues. Renters are more likely than homeowners to report financial difficulties and the share experiencing these difficulties declines as age increases.

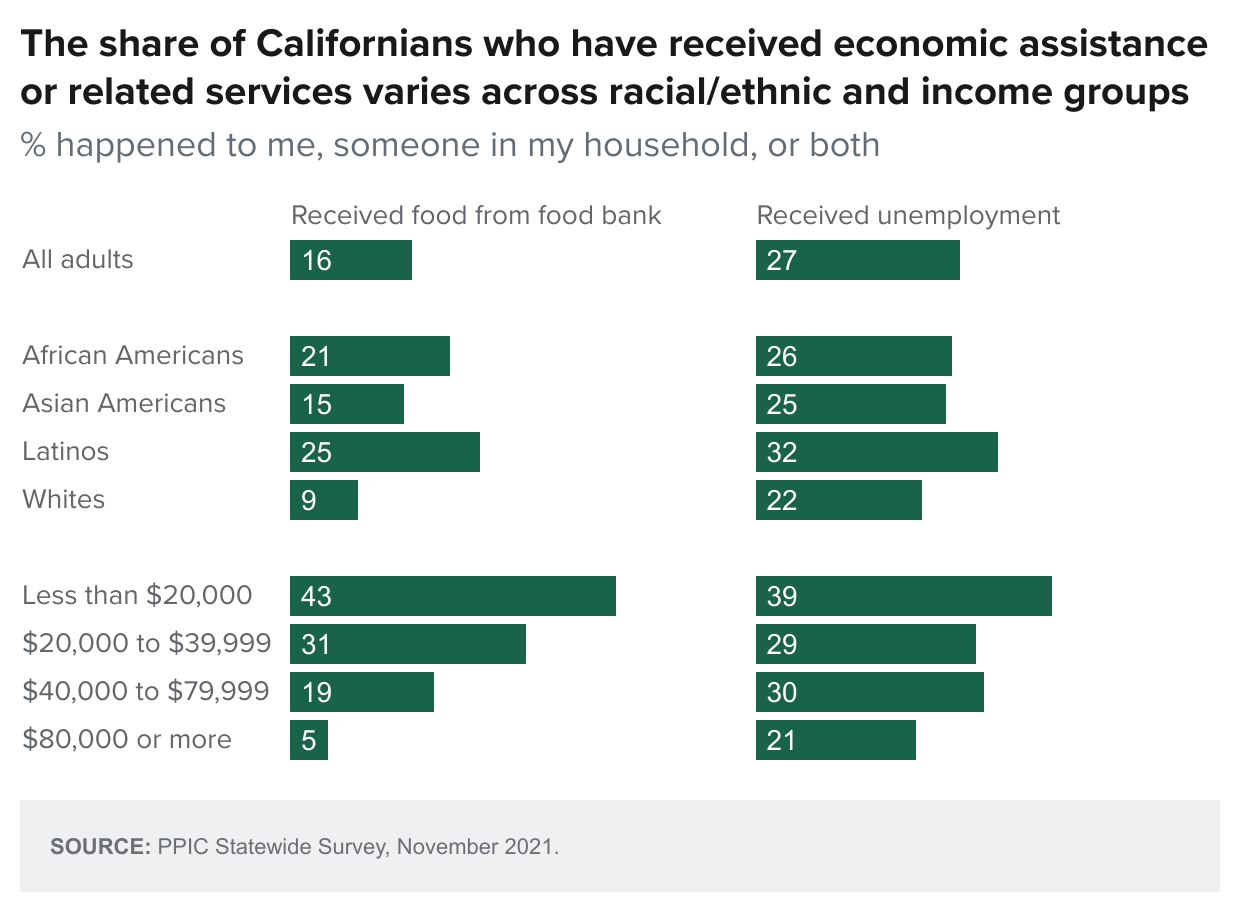

Sixteen percent of Californians say they or someone in their household has received food from a food bank in the past year, and 27 percent received unemployment benefits. These shares were similar last November. Lower-income Californians are the most likely to report receiving economic assistance or related services; the share receiving assistance is highest among households earning less than $20,000. Across racial/ethnic groups, Latinos and African Americans are more likely than Asian Americans or whites to have received food from a food bank, while Latinos are somewhat more likely than those in other racial/ethnic groups to have received unemployment. Renters are much more likely than homeowners to say they have received assistance.

More than one in four Californians say they or someone in their household has had their work hours reduced or pay cut (28%) and about two in ten say someone has lost their job (19%) in the past 12 months, while nearly half (49%) have worked from home. The share of Californians who had pay or work hours cut was much higher last November amid COVID lockdowns (41%). Across racial/ethnic groups, Latinos are the most likely to have experienced job loss or cuts to hours or pay, while Asian Americans are the most likely to have worked from home. Households with incomes of less than $80,000 are much more likely to have faced job loss or reductions in pay or hours. The share of Californians who report working from home is far higher among more-affluent households; it increases as education levels rise and declines with age.

Financial Worries

Despite improved economic circumstances compared to last November, a substantial number of Californians continue to worry about their financial situation. About one in four worry every day or almost every day about saving for retirement (27%) and the cost of housing (25%); two in ten worry about the amount of debt they have (20%) and about health care costs for them and their family (19%). Similar shares reported these worries 12 months ago. Financial worries are more common in lower-income households, and about one in four or more Californians earning less than $20,000 worry about these financial issues every day or almost every day. The shares who worry frequently about these financial stressors vary across racial/ethnic groups. The share of adults who are worried about each of these issues decreases slightly as education levels rise. Renters are much more likely than homeowners to worry about the cost of housing, debt, and saving for retirement.

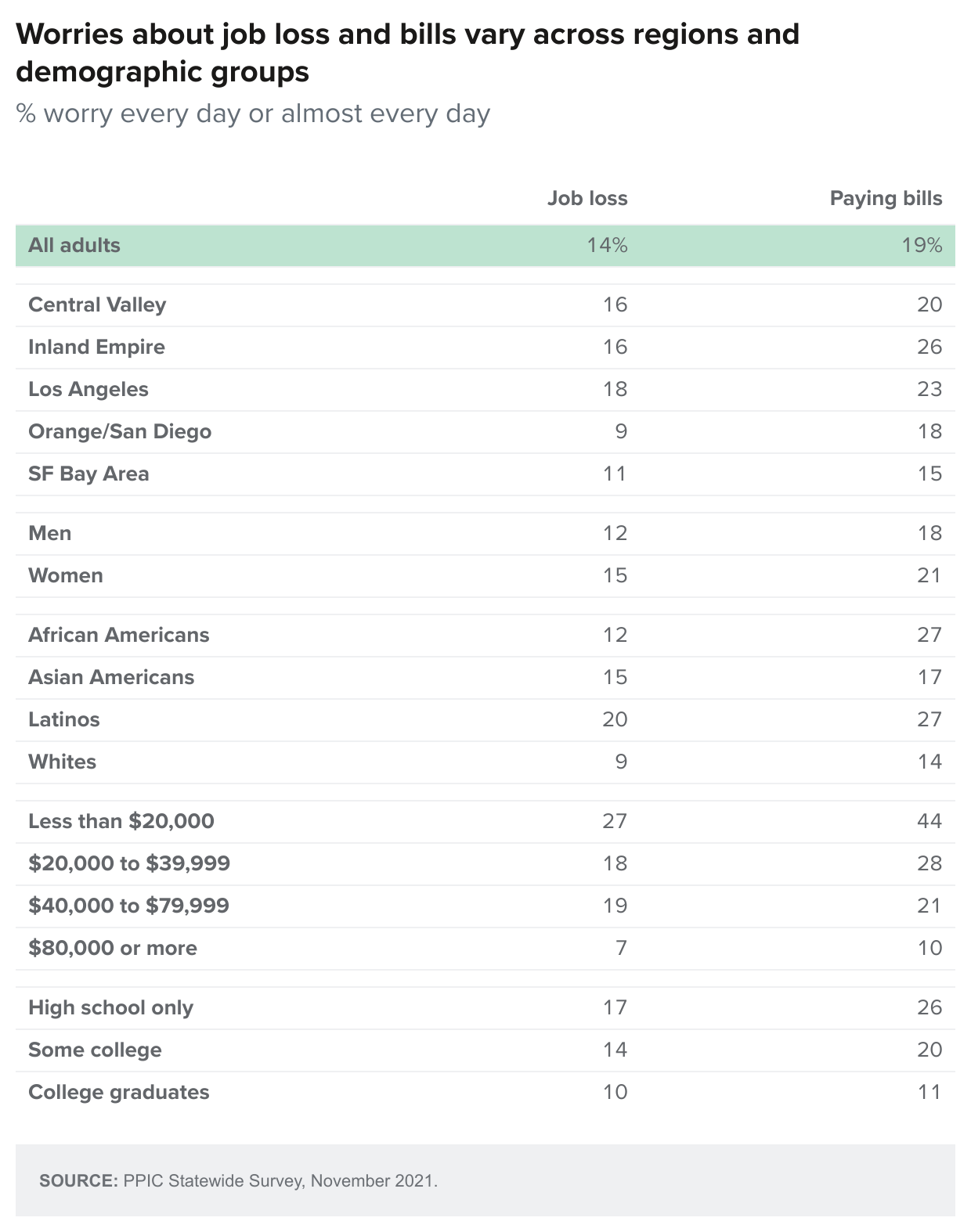

About two in ten Californians (19%) worry every day or almost every day about paying their bills, and 14% worry about job loss. Similar shares had these financial worries last November. Regionally, concern about paying bills is highest in the Inland Empire and lowest in the San Francisco Bay Area, while worries about job loss are highest in Los Angeles and lowest in Orange/San Diego. Across racial/ethnic groups, Latinos are the most likely to be worried about job loss, while African Americans and Latinos are the most likely to worry about paying bills; whites are the least likely to be worried about either of these issues. Californians earning less than $20,000 are the most likely to worry: 44% worry every day or almost every day about paying bills and 27% worry about job loss. Concern about job loss and paying bills declines as education levels rise.

Job Conditions

When asked about job satisfaction, 37 percent of employed adults are very satisfied and 53 percent are somewhat satisfied, while 10 percent say they are not satisfied with their current job. Satisfaction has increased since last November, when 82 percent of employed adults expressed satisfaction compared to 90 percent today. Asian Americans are less likely than other racial/ethnic groups to say they are very satisfied with their current job. Across income groups, the share saying they are very satisfied is highest among those making $80,000 or more.

Six in ten employed Californians say their jobs offer opportunities for growth, and about half (51%) say they are provided with educational or training assistance. Similar shares of men and women say they have opportunities for growth and advancement at work and are offered educational/training assistance. African Americans are somewhat more likely than any other racial/ethnic group to say their jobs provide opportunities for growth or educational/training assistance. The shares saying their jobs offer either of these increase with rising educational attainment and income. Employed adults with an income of less than $20,000 are the least likely across all demographic groups to say their current job offers either of these benefits.

About eight in ten adults completely (43%) or somewhat (38%) agree with the idea that it is important for workers to organize so that employers do not take advantage of them, and a similar share agree at least somewhat with the idea that voting gives people like them a say in what the government does (39% completely, 42% somewhat). There is agreement among partisan groups on both issues.

Workforce Policies

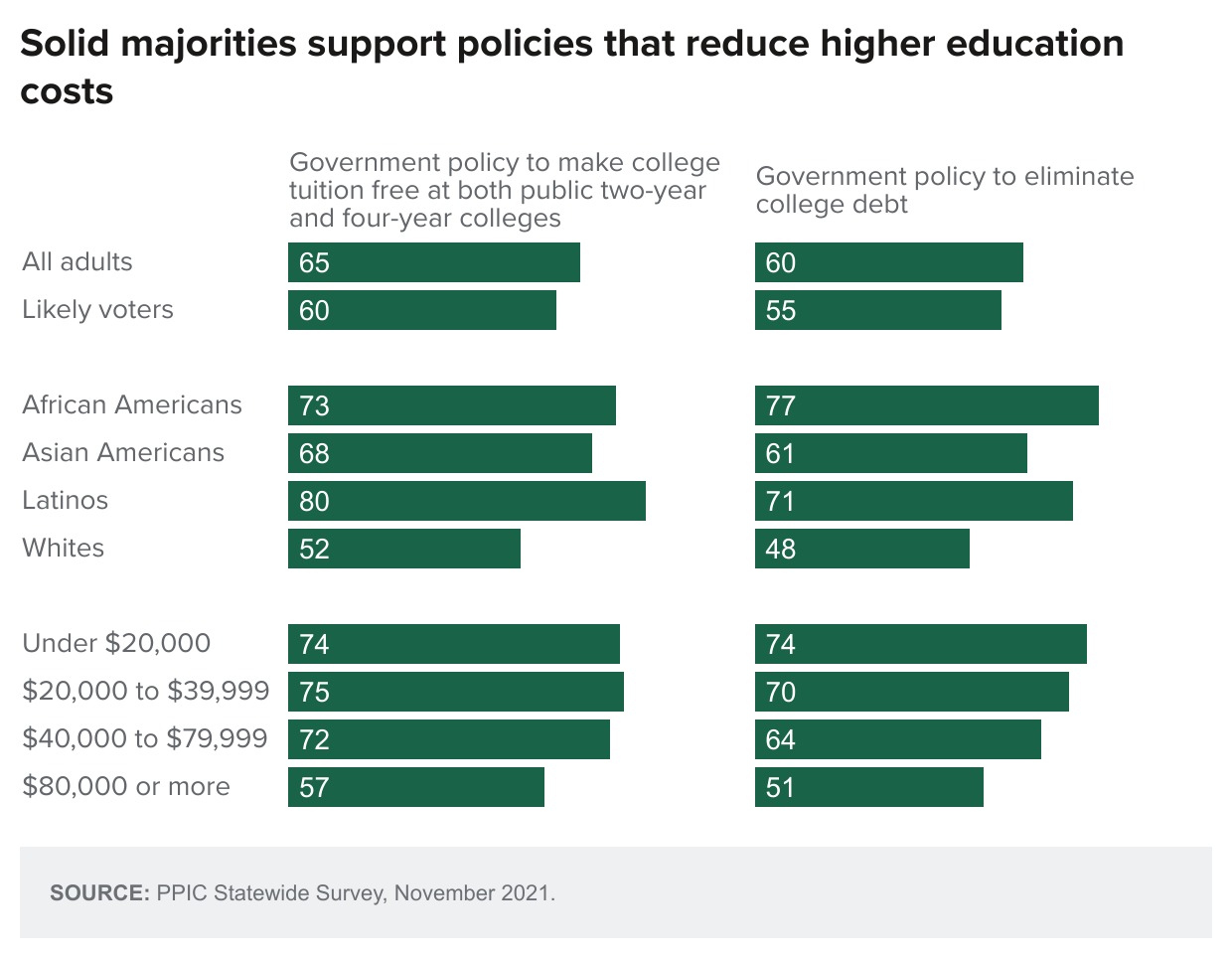

When asked about policy proposals to address the cost of higher education, nearly two in three Californians (65% adults, 60% likely voters) support a government policy to make college tuition free at both public two-year and four-year colleges, and about six in ten Californians (60% adults, 55% likely voters) support a government policy that would eliminate college debt. Democrats and independents largely support these policies, while majorities of Republicans oppose both. Across racial/ethnic groups, whites are the least likely to support these policies, though nearly half are in favor. Support is lowest among college graduates, those 55 and older, and those with incomes of $80,000 or more.

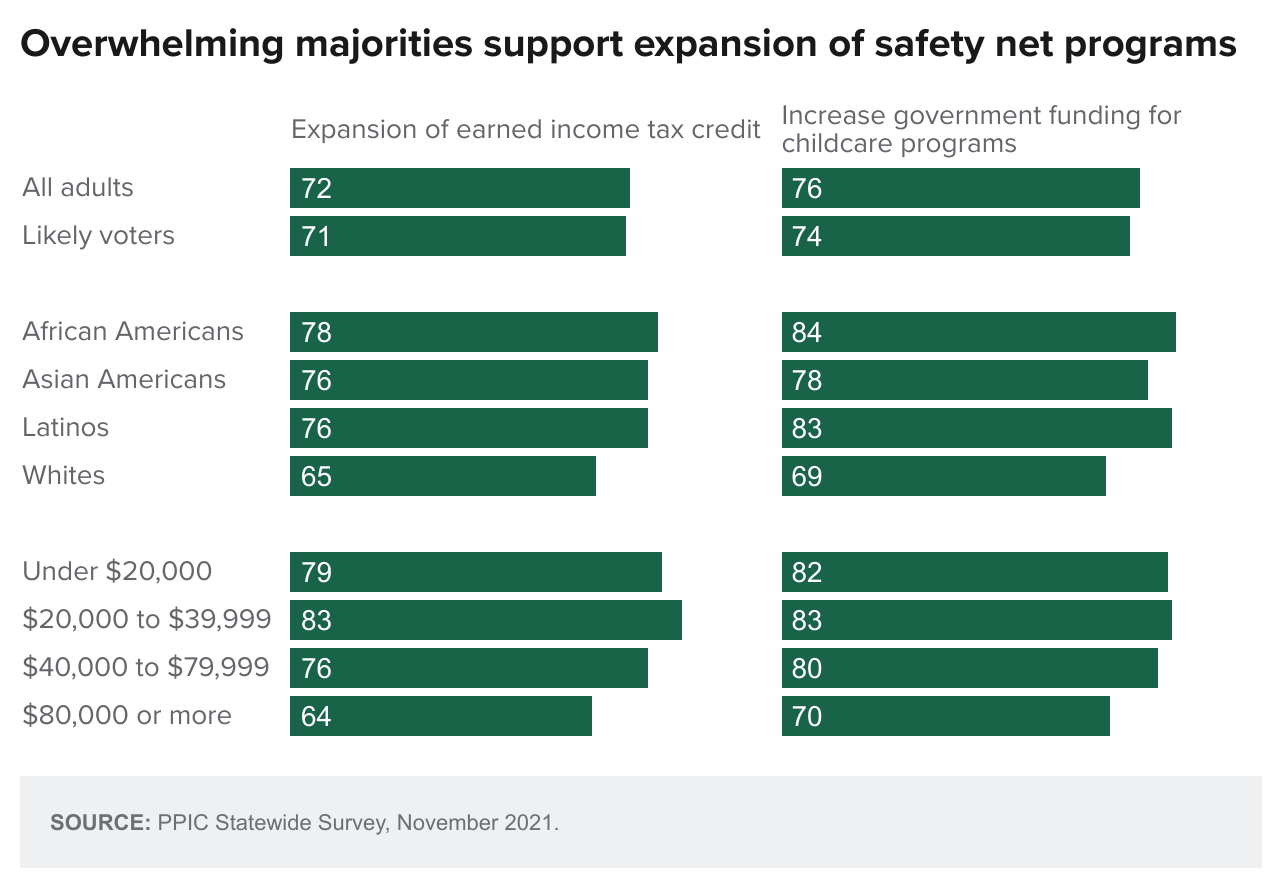

About seven in ten adults (72%) and likely voters (71%) are in favor of expanding eligibility for and payments of the earned income tax credit for lower-income working families and individuals. When asked whether they support increasing government funding so that childcare programs are available for more lower-income working parents, overwhelming majorities of adults (76%) and likely voters (74%) are in favor. Overwhelming majorities of Democrats and independents support increased funding for childcare programs and the expansion of earned income tax credits; about six in ten Republicans oppose both. While about two in three whites support both of these policies, they are the least likely to hold this view across racial/ethnic groups. Solid majorities across income groups favor these policies, but support is lowest among those making $80,000 or more.

Eight in ten adults (81%) and likely voters (82%) are in favor of increasing government funding for job training programs and about three in four (77% adults, 74% likely voters) support government offering a health insurance plan, similar to Medicare, that Americans can choose to purchase instead of private insurance. Majorities across partisan groups agree on increasing funding for job training programs, but there is a wide partisan divide on government-funded health care.

Topics

Affordability COVID-19 Economy Health & Safety Net Higher Education Political Landscape PPIC News Statewide Survey Workforce NeedsLearn More

After the Recall, More Californians Want Changes to the Process

California’s Mood Darkens on the Economy

California’s Workplaces Today—and Tomorrow

Californians Agree It’s Important for Workers to Organize

Californians and the American Dream

Californians See a Widening Economic Divide

Californians’ Financial Worries and Woes

Video: Californians and Their Economic Well-Being