For years, exorbitant housing costs in California have priced out many prospective homebuyers. At the same time, rapidly rising home prices have led to unprecedented levels of wealth among homeowners, including a growing number who have record amounts of home equity. In 2020, more than 700,000 California households had at least one million dollars in equity in their homes, according to American Community Survey data. With rapid price appreciation between 2020 and 2022, we estimate that approximately 1.2 million California households are now home-equity millionaires.

Who are these house-rich Californians?

- Most have paid off their mortgages. In 2020, 58% of the state’s equity millionaires owned their homes free and clear. Statewide, there has been a dramatic rise in the number of Californians who have paid off their mortgages, from 1.6 million households in 2000 to 2.4 million in 2020. The share of all owner-occupied homes that have no mortgage increased from 25% to 33% over that same time frame.

- Most have lived in their homes for a long time. About half have lived in their current home for more than 20 years. Those with no mortgage have stayed put the longest, with about one-third living in their homes for 30 or more years, compared to 11% of those with a mortgage, and 2% of renters. These long tenures are a testament to the important role that long-term homeownership plays in building household wealth.

- Because so many of them bought their homes decades ago, high-equity homeowners partly reflect the demographics of the state’s past rather than the California of today. The most common age group for high-equity owners is 65–69, compared to 55–59 for other homeowners, and 30–34 for renters.

- Equity millionaires are more likely to be white or Asian compared to other homeowners or renters. White and Asian homeowners make up the vast majority of high-equity homeowners (87%). In contrast, only 13% of high-equity homeowners are Latino, Black, or Native American. These differences reflect and exacerbate other kinds of inequality in California, including income inequality and educational inequality.

- On average, high-equity homeowners with no mortgage are more educated and have higher incomes than renters, but they tend to be less educated and have lower incomes than those with a mortgage. This partly reflects the older ages of high-equity homeowners with no mortgage, many of whom are retired and became homeowners many decades ago when college enrollment and completion were less common.

- High-equity homeowners who own their home outright pay less in property taxes than those with a mortgage, largely because of Proposition 13, which limits increases in property valuations for the purpose of taxation. High-equity owners without a mortgage have an annual median payment of $7,100, compared to over $10,000 for those with a mortgage.

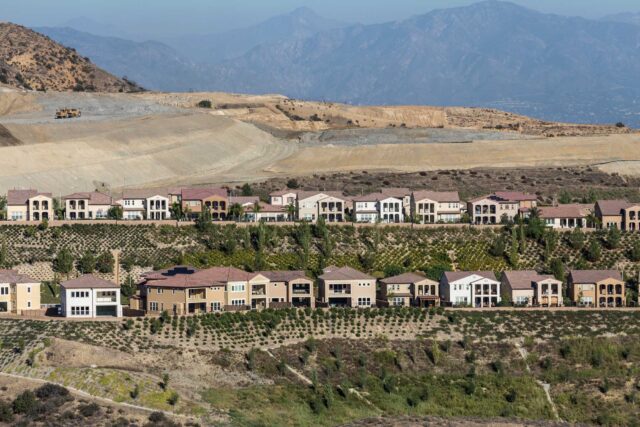

- The vast majority of California’s high-equity homeowners live in coastal metropolitan counties. Even though homeowners with no mortgage are more likely to live in inland metropolitan and rural areas, where homeownership rates are higher and housing prices are lower, those with the highest equity tend to live in expensive coastal metropolitan areas, especially the Bay Area and coastal Southern California.

Homeownership has been key to wealth creation for generations of Californians. Residents who came of age in the 1950s and 1960s did so in an era of rapid expansion of homeownership. After World War II, new transportation infrastructure coincided with the massive construction of new suburbs with abundant housing, loans became more accessible for many, and housing prices in California were only somewhat higher than in the rest of the nation. Over time, many of those homeowners became California’s equity millionaires. But redlining and discriminatory lending practices during that period kept many people of color from homeownership.

Today, high housing costs limit young adults’ access to this means of wealth creation. In 1960, over half (54%) of 30-to-34-year-olds in California owned a house, compared to about a third today. Finding ways to improve homeownership among young adults is central to housing stability and future housing equity. Certainly one important part of the solution is to build more housing, including affordable housing intended for homeownership. Other approaches seek to help first-time homebuyers. For example, some state leaders have proposed the “The California Dream for All” program, which would help first-time buyers with down payments. PPIC will continue to monitor and report on these and other potential solutions to California’s housing crisis.