Fifty-six percent of California small businesses experienced “large negative” effects from the pandemic, according to a recent Census survey—a survey that includes businesses with up to 500 employees. Sectors hit hardest by initial job loss face the most severe setbacks. As small businesses weather closures brought on by COVID-19, policy efforts to support them will be important for the state’s economic recovery.

Ninety-five percent of businesses are very small businesses with less than 50 employees, and these businesses employ one-third of California’s workers. Unemployed Californians will need workplaces to return to after the state recovers—small and very small businesses are a common place for workers to land.

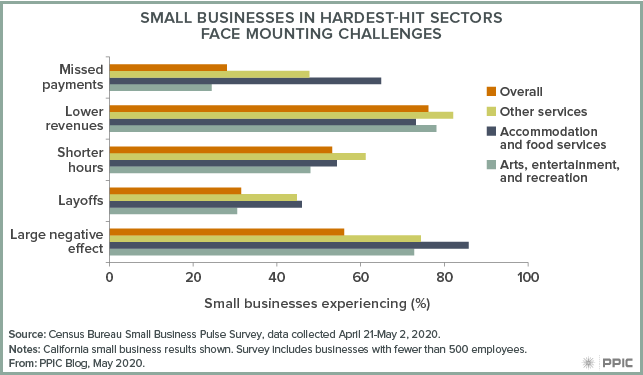

In response to the pandemic, about three-quarters of small businesses in hard-hit sectors, such as food service and entertainment, have had to take dramatic measures. That is, today business owners in these sectors are much more likely to have laid off employees, decreased employee hours, or suffered revenue losses since mid-April, compared to other sectors.

Compounding these struggles, many small businesses have already missed scheduled payments such as rent, utilities, or payroll. The impact has been particularly stark in accommodation and food services, where nearly two-thirds of business owners have missed payments since March 13.

Very small businesses are more likely to be owned by women and nonwhite Californians than larger businesses. Latinos own 11% of these businesses but only 2% of larger businesses. Similarly, Asians own 23% of very small businesses versus roughly 10% of larger businesses. In California, women run 22% of such businesses, compared to 7% of larger businesses.

Within the industries hit hardest by COVID-19, very small businesses with less than 50 employees have even higher rates of Asian, Latino, and women ownership. In particular, one-third in this heavily affected sector—for example, restaurants and retail—are Asian-owned. Women also own 26% of very small businesses in these industries; another 20% are jointly owned by men and women.

Despite policymaker concerns about the survival of small businesses, initial efforts to provide assistance have fallen short of expectations. Over 88% of California small businesses in accommodation and food services applied for federal assistance through the Paycheck Protection Program (PPP), yet only 27% received any support. For other federal programs like Economic Injury Disaster Loans (EIDL) and Small Business Administration (SBA) Loan Forgiveness, less than half of the businesses in hard-hit industries that requested funding received any.

Policies to help these businesses manage the current downturn will influence the state’s economic recovery. Small businesses employ many of California’s workers, and small business ownership offers a path to economic mobility and success. In addition, young businesses—many of which are small—play a particularly important role in job creation.

While federal assistance will remain critical, state and local efforts can help fill the gap. Because some communities lack sufficient resources, state efforts to provide financial assistance through the Small Business Loan Guarantee Program are a step in the right direction.