The pandemic downturn has amplified housing instability in an already volatile sector, and while policy action in California has focused on renters, homeowners and landlords also risk financial consequences due to the virus. Recent legislation raises concerns about how comprehensive housing relief efforts have been. After the temporary evictions and foreclosures moratorium put in place by the Judicial Council was lifted on September 1, the state enacted more concrete legislation to grant renters financial relief. But homeowners were left with questions about protections against foreclosures.

In California, legislative negotiations produced bills aimed at supporting renters, including the recently enacted Tenant, Homeowner, and Small Landlord Relief and Stabilization Act of 2020 (AB 3088), which protects renters from no-cause and certain other types of evictions—including nonpayment due to COVID-19—through January 31, a victory for Californians at heightened risk of eviction due to economic hardships. However, homeowners who hold a mortgage received less comprehensive protections, and foreclosures due to COVID-19 hardships were not halted.

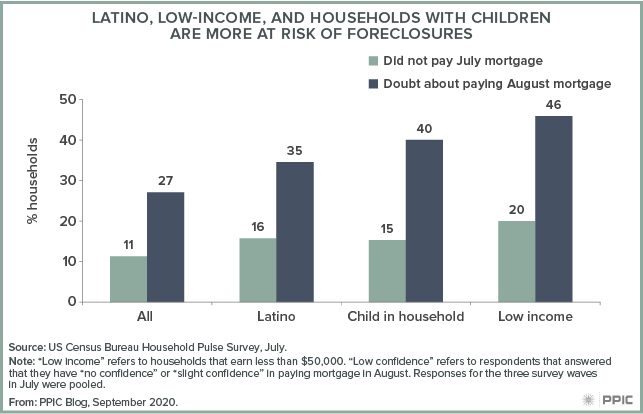

Without relief for homeowners, certain groups may be at risk. Homeowners reported lower rates of job loss (30%) and worry over personal finances (27%) than renters in the July PPIC Statewide Survey, but disparities exist among subgroups. Compared to all homeowners who hold a mortgage, Latino, low-income, and households with children reported higher rates of nonpayment and low confidence in paying August mortgage. Compared to all homeowners, more Californians within those subgroups have a mortgage rather than own their home outright.

Recent policy also may impact homeowners who rent out property on which they pay a mortgage. At the federal level, a Centers for Disease Control and Prevention (CDC) order to temporarily suspend evictions until the end of the year leaves states to handle financial relief for homeowners with mortgages and for small landlords impacted by the order. The CDC order expressly states that foreclosures are not prohibited, but does not preclude individual states from taking action on that front. This complicates the rent-payment dynamic and raises concern among landlords who rely on rental income to meet their mortgage payments. Further policy actions to address financial hardships faced by homeowners can help mitigate disparities across those who hold mortgages and reduce the burden on small landlords and their renters.

In California, AB 3088 provides a degree of anti-foreclosure protection by extending the California Homeowner Bill of Rights to small, noncommercial landlords, requiring mortgage servicers to contact borrowers before pursuing foreclosure proceedings. It also enumerates how landlords may eventually collect rent they are owed, indicating they may pursue unpaid rent after March 1, 2021. In the meantime, landlords, renters, and homeowners alike look to further federal action.