Governor Newsom has proposed creating a state individual mandate to help fund increased health insurance subsidies for low- and middle-income Californians. One of the major reforms ushered in by the Affordable Care Act, the federal individual mandate—which was rolled back in the federal tax bill passed in 2017—required most individuals to have comprehensive health insurance or pay a tax penalty. The governor’s administration projects approximately $500 million in revenue from the mandate, based on the total amount paid by Californians in 2016.

As the governor and legislature consider a state mandate, it’s worth examining which Californians paid the federal mandate penalty.

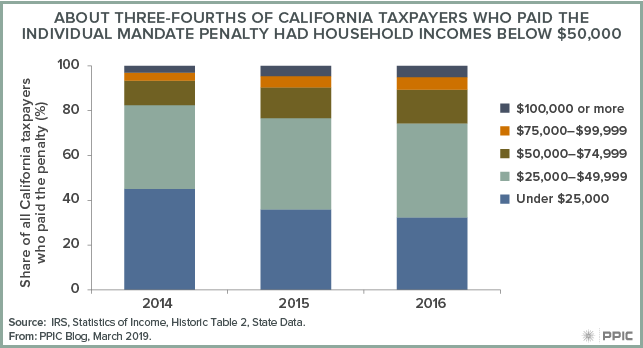

Between 2014 and 2016, taxpayers with incomes below $50,000 accounted for a vast majority of returns that included the individual mandate penalty. In 2014, the first year the individual mandate went into effect, the penalty was 1% of income or a maximum of $285 per family ($95 per adult and $47.50 per child). More than 1 million tax returns in California paid the penalty. Taxpayers with incomes below $25,000 accounted for about 45% of returns subject to the penalty, while those with incomes between $25,000 and $50,000 accounted for another 37%. Even more low-income individuals would have been subject to the penalty if not for certain exemptions—such as having an income below the tax filing threshold ($12,500 for a single adult) or facing hardships like bankruptcy and eviction.

In 2016, the minimum payment rose to 2.5% of income or a maximum of $2,085 per family ($695 per adult and $347.50 per child). The total number of taxpayers subject to the penalty dropped to about 600,000. Those with incomes below $50,000 still accounted for nearly three-fourths of all payments, though this was down from 83% in 2014.

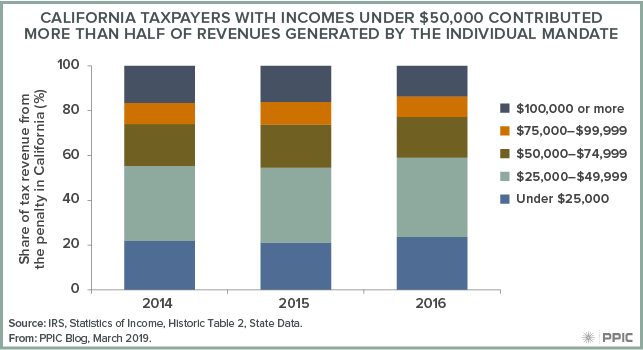

The revenues generated also disproportionately came from taxpayers in lower income brackets. In 2014, taxpayers with incomes below $50,000 accounted for more than 55% of the $222 million in total payments from California taxpayers. Those with incomes under $25,000 paid more than $48 million and those with incomes between $25,000 and $50,000 paid more than $74 million.

Although the number of taxpayers subject to the penalty dropped from 2014 to 2016, tax revenue doubled—in part because the penalty amount increased—and reached $446 million in 2016. Over this time, the share of the total amount paid by households with incomes of $100,000 or more decreased, from 17% to 14%. Meanwhile, the share of revenue paid by those with incomes below $50,000 rose, from 55% in 2014 to 59% in 2016.

If the state does implement the governor’s proposal, the revenue would increase subsidies currently available for individuals with incomes between 250% and 400% of the federal poverty level ($31,225–$49,960 for a single adult) and expand subsidies to individuals with incomes between 400% and 600% of the federal poverty level ($49,960–$74,940). Most Californians with lower incomes are eligible either for no-cost Medi-Cal or heavily subsidized coverage through Covered California—though not everyone who is eligible enrolls in these programs.

The repeal of the federal individual mandate is expected to lead to an increase in the number of uninsured individuals and higher insurance premiums. A state individual mandate might help counteract those effects by encouraging healthy individuals to enroll in coverage—but at a cost.

In an otherwise progressive state tax structure, the implementation of the federal mandate disproportionately affected low-income Californians. There’s also evidence that some Californians paid the penalty even though they should have been exempt. If the state revives the mandate, the governor and legislature should consider how to improve awareness about eligibility and exemptions so this problem can be avoided. At the same time, reducing the number of people paying the penalty also means that the governor’s revenue estimate may need to be lowered. As policymakers engage in discussions over a state individual mandate, assessing who bears the burden of the tax and who benefits will be an important consideration.