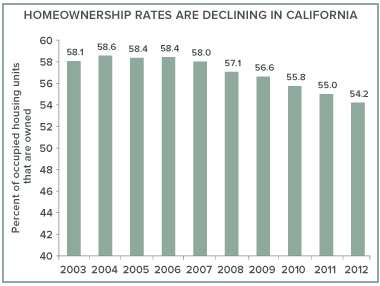

Homeownership is on the wane in California. Between 2006 and 2012, the number of owner-occupied housing units in California declined by more than 320,000, while the number of renter-occupied housing units increased by more than 720,000. Never before has the state seen such dramatic declines in the number of owner-occupied houses. As a result, homeownership rates in California are at their lowest levels in more than 50 years.

The decline in owning and the rise in renting are largely a result of the housing bust between 2007 and 2011. Single-family housing units, long the primary domain of the homeowner in California, were the most likely to be lost to foreclosure. Thousands of owner-occupied homes were sold or foreclosed upon, and many became rentals.

The decline in owning and the rise in renting are largely a result of the housing bust between 2007 and 2011. Single-family housing units, long the primary domain of the homeowner in California, were the most likely to be lost to foreclosure. Thousands of owner-occupied homes were sold or foreclosed upon, and many became rentals.

However, even during the bust, housing prices remained relatively high in the state’s heavily populated coastal areas, which meant that ownership continued to be unaffordable for many renters who might prefer to buy. It may come as no surprise that states with low housing prices tend to have the highest homeownership rates. For example, median home values in West Virginia and Michigan are among the lowest in the nation—less than $120,000 in 2012—and rates of homeownership in those states are above 70 percent—among the highest in the nation. In contrast, in New York, California, and Hawaii, housing values are high and homeownership rates are among the lowest in the nation.

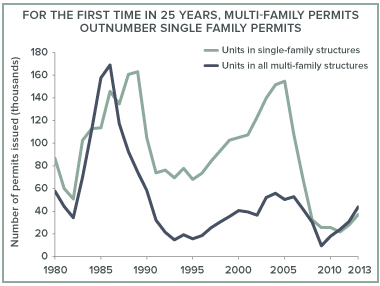

Housing construction in California reflects the increase in demand for rentals. In recent years, most new construction has consisted of large multi-unit buildings, most of which are rentals. This focus on multi-unit construction also reflects a shift among planners and local officials toward encouraging high-density in-fill development. This shift is especially apparent in expensive coastal housing markets where there is not a lot of room for new housing. In Los Angeles County, multi-unit buildings accounted for 86 percent of the increase in occupied housing units between 2010 and 2014. In the Bay Area, 60 percent of net new occupied housing units were in multi-unit buildings. By contrast, in inland areas such as Sacramento County and the Inland Empire, three of every four newly occupied housing units were single-family dwellings.

Housing construction in California reflects the increase in demand for rentals. In recent years, most new construction has consisted of large multi-unit buildings, most of which are rentals. This focus on multi-unit construction also reflects a shift among planners and local officials toward encouraging high-density in-fill development. This shift is especially apparent in expensive coastal housing markets where there is not a lot of room for new housing. In Los Angeles County, multi-unit buildings accounted for 86 percent of the increase in occupied housing units between 2010 and 2014. In the Bay Area, 60 percent of net new occupied housing units were in multi-unit buildings. By contrast, in inland areas such as Sacramento County and the Inland Empire, three of every four newly occupied housing units were single-family dwellings.

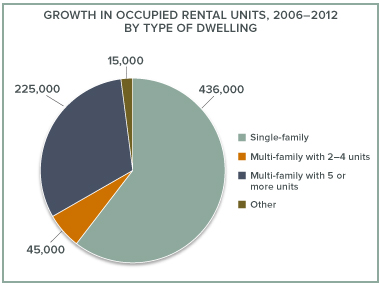

These newly constructed multi-family units make up just a fraction of the recent growth in renter households. Conversions of owner-occupied single-family homes to rentals have captured a large portion of growth in renter-occupied units. Between 2006 and 2012, 60 percent of the increase in rented occupied units occurred in single-family units (about 436,000 units). In 2006, before the bust, only 21 percent of occupied single-family houses were rented; by 2012, the share of houses occupied by renters had increased to 26.0 percent.

Will the trend toward renting reverse as the state’s economy continues to recover? A key consideration is whether the rise in renting represents a long-term shift in preferences. High home prices and past volatility in the housing market may have led many to conclude that owning a home is simply not worth the risk. On the other hand, rapidly rising rents have made homeownership relatively more attractive. And all this is happening as large numbers of young adults are reaching prime ages for starting a household and buying a first home. If historic trends are any indication, these demographic forces—along with low interest rates and improved labor markets—should lead to increases in homeownership rates.

Will the trend toward renting reverse as the state’s economy continues to recover? A key consideration is whether the rise in renting represents a long-term shift in preferences. High home prices and past volatility in the housing market may have led many to conclude that owning a home is simply not worth the risk. On the other hand, rapidly rising rents have made homeownership relatively more attractive. And all this is happening as large numbers of young adults are reaching prime ages for starting a household and buying a first home. If historic trends are any indication, these demographic forces—along with low interest rates and improved labor markets—should lead to increases in homeownership rates.